child tax credit november date

Also the final. The taxpayers that have eligible children under the age of 6 receive 300 per child and 250 for every child between 6 and 18.

Learn About My529 Utah S Official 529 College Savings Plan

Be under age 18 at the end of the year.

. Most parents automatically get the enhanced credit of up to 300 for each child up to age 6 and 250 for each one ages 6 through 17. November 25 2022 Havent received your payment. Child Tax Credit Norm Elrod.

If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit. November 12 2021 926 AM CBS Los Angeles. Lets condense all that information.

To reconcile advance payments on your 2021 return. 13 opt out by Aug. NOVEMBERs child tax credit cash will be sent out to parents in need across the country next week.

IR-2021-222 November 12 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. 15 opt out by Aug. Most parents automatically get the enhanced credit of up to 300 for each child up to age 6 and 250 for each one ages 6 through 17.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. November 12 2021 at 1226 pm. In 2021 more than 36 million American families may be eligible to receive a child tax credit.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Get your advance payments total and number of qualifying children in your online account. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The IRS is scheduled to send the final payment in mid-December. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. But many parents want.

Max refund is guaranteed and 100 accurate. Here is some important information to understand about this years Child Tax Credit. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000. Wait 10 working days from the payment date to contact us.

Be your son daughter stepchild eligible foster child brother sister. However the deadline to apply for the child tax credit payment passed on November 15. The fully refundable tax credit which is usually up to 2000.

Generally you need to unenroll by at least three days before the first Thursday of the month in which the next payment is scheduled to arrive you have until 1159 pm. CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. Alberta child and family benefit ACFB All payment dates.

This change in the child tax credit doubled the credits value and expanded the age limit which was 17. Low-income families who are not getting payments and have not filed a tax return can still get one but they must sign up on. In 2022 the tax credit could be refundable up to 1500 a rise from 1400 in 2020 due to inflation.

Wait 5 working days from the payment date to contact us. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 12 2021 Published 1036 am.

Benefit and credit payment dates. Enter your information on Schedule 8812 Form. Eleven other states currently provide their own child tax credit plans in an effort to.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly for each child. A childs age determines the amount. Parents of a child who.

CBS Baltimore The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming. The IRS is scheduled to send the final payment next month. The tax credit was introduced as part of the 2022-2023 budget bill and signed into law in June by Governor Ned Lamont.

Related services and information. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Depending on your income you must have earned income of at least 2500 to be eligible for the refund.

It offers a 250 per child tax credit for up to three children - worth up to 750 per family - and the payments are expected to go out in late August Lamont said. The Internal Revenue Service will soon start sending out the advanced payments of the child tax credit for November. Free means free and IRS e-file is included.

The Child Tax Credit provides money to support American families. The stimulus check part of President Joe Bidens child tax credit plan will see those who meet the final November 15 deadline potentially receive. Parents income matters too.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. To be a qualifying child for the 2021 tax year your dependent generally must.

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Icai Submitted Representation To Cbdt Requesting For Extension Of Time For Submission Of Tax Audit Reports And Related Retur Taxact Business Updates Income Tax

2 Child Limit Policy Low Incomes Tax Reform Group

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Refundable Tax Credits Congressional Budget Office

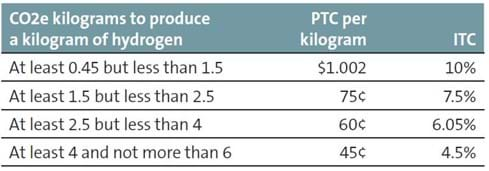

Hydrogen Funding And Tax Credits Norton Rose Fulbright December 2021

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Bio Plastics Europe News Events

Dates Cost Of Living Payments Will Be Paid To Uk Households Nationalworld

Child Tax Credit Will There Be Another Check In April 2022 Marca

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Scholastic Book Fair Scholastic Book Book Fair

What Are Marriage Penalties And Bonuses Tax Policy Center

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Input Tax Credit Tax Credits Business Rules Reverse

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center